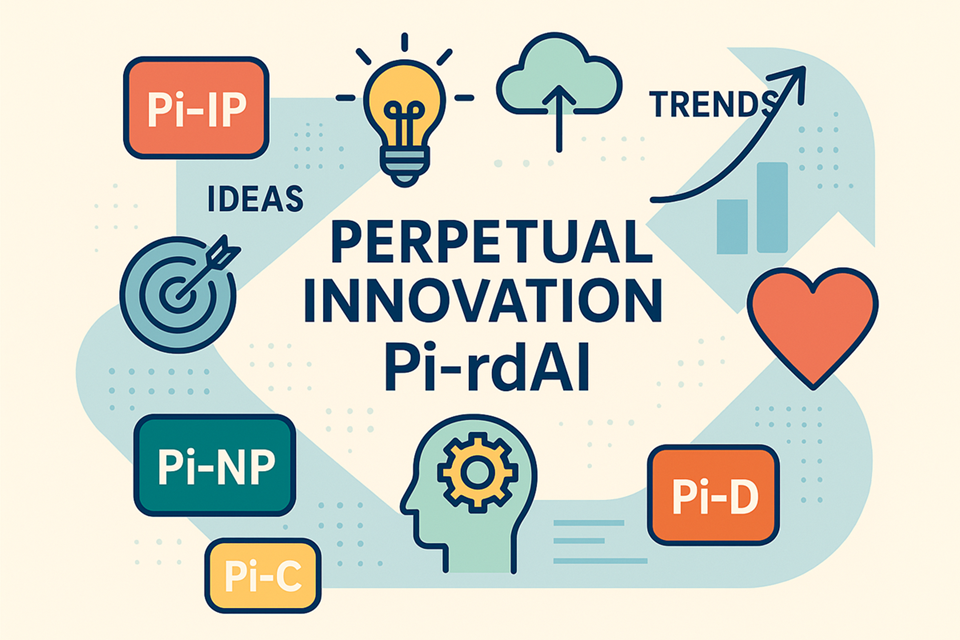

Welcome to Perpetual Innovation™ (Pi)

Plan Fast. Act Smart. Make a Difference!™

Welcome to PerpetualInnovation.org, the knowledge and innovation side of our platform. The Pi (Perpetual Innovation™) menu gives you access to books, blog content, GenAI tools, and guided strategy models that help individuals and organizations develop, refine, and regenerate strategic plans.

This site supports entrepreneurs, nonprofits, donors, and civic clubs — offering rapid planning, AI-enhanced tools, and custom GPTs for high-impact decision-making.

What Is Pi?

Perpetual Innovation™ is a structured, regenerative planning approach. Each Pi section focuses on a different theme, combining:

- Real-world planning frameworks

- Regenerative Dynamic AI (rdAI) techniques

- Custom GPT agents

- Free blog insights and resource pages

- Companion books and workbooks by Dr. Elmer Hall

Pi Sections — Explore Each Hub

Pi-rdAI: Rapid Strategic Planning

Pi-rdAI is your entry point for fast, regenerative planning. It combines traditional strategic models (SWOT, mission alignment, goal setting) with AI-enhanced planning tools that reduce weeks of effort into hours or days. It also includes workshop formats, templates, and the rdAI-powered GPT agent to regenerate and extend your work.

Use this for:

Business plans

Nonprofit or foundation strategies

Workshop facilitation and strategy coaching

🔗 Pi-rdAi

Pi-Nonprofit: Strategy for Charities & Civic Impact

This section supports nonprofit boards, directors, and donors with frameworks for fast, fundable, and board-ready plans. Based on the books Perpetual Innovation: Strategic Planning for Nonprofits and The Club Management Workbook, it covers:

Nonprofit Management

Donor & Impactful Giving

Civic & Club Leadership (Rotary, Lions, Kiwanis)

It also features the Pi-C Charity Review GPT — a free tool for evaluating a list of charities for their reporting compliance and transparency. Find the GenAI custom GPT agents over on the books and resources page.

🔗 Pi-Nonprofit (now integrated with blog posts from: NonprofitPlan.org and CharityPlan.org)

Pi-Sustain: Sustainability Strategy

Built on the book Perpetual Sustainability: A Systems-Based Planning Guide, this section explores how to build viable, long-term strategies for environmental and economic balance. Topics include:

Regenerative business models

Circular economy strategy

Climate-focused innovation

Integrated social, environmental, and economic systems

It also integrates older content from SustainZine and new blog posts on regenerative thinking.

🔗 Pi-Sustain (now integrated with blog posts from: SustainZine.com)

Pi-Scenario: Future-Ready Strategy

Pi-Scenario introduces tools and content for scenario planning and Delphi-based decision support. Use it to prepare for uncertainty and explore long-term outcomes with clarity and strategic flexibility.

Based on the forthcoming Scenario Planning Primer, it includes:

Introduction to scenario development

Delphi method for group insight

Strategy alignment for multiple futures

Blog posts from DelphiPlan.com and ScenarioPlans.com

🔗 Pi-Scenario (& Pi-Delphi) (now integrated with blog posts from: ScenarioPlans.com and DelphiPlan.com)

Pi-IP: Innovation & Intellectual Property Strategy

This section helps inventors, innovators, and universities plan for IP protection, commercialization, and funding. Based on consulting experience with research institutions, this page introduces:

Innovation readiness and tech transfer strategy

Patent review & commercialization pathway

SBIR/STTR and early-stage funding guidance

Regenerative tools for IP evaluation and alignment

Content here supports university tech transfer offices, startups, and grant-funded teams working in high-tech innovation.

🔗 Pi-IP (now integrated with blog posts from: IntellZine.com)

The Perpetual Innovation™ Book Series

Each Pi hub is grounded in a companion book or workbook in the Perpetual Innovation™ series by Dr. Elmer Hall. These books provide self-guided tools and structured planning processes for strategy, donor impact, IP development, and sustainability.

🔗 https://www.amazon.com/author/elmerhall

AI Tools and GPT Agents

Several Pi pages include custom GPT agents built on ChatGPT — such as the Pi-C Charity GPT — designed to help users replicate planning models and evaluate strategic options in real time.

These free tools let you build and regenerate plans rapidly using AI in a structured, ethical way. Find the GenAI custom GPT agents over on the books and resources page.

Explore the Pi Blog

All blog posts on PerpetualInnovation.org are tagged by category — including:

Nonprofit Strategy

Sustainability

Innovation & IP

Foresight & Scenario Planning

Ready to Get Started?

Use Pi to explore at your own pace. Or combine it with SBPlan.com consulting services to bring structure, coaching, and facilitation into your next planning cycle.

Plan Fast. Act Smart. Make a Difference!™

📣 Ready to Start?

Pick your track. Build your plan. Regenerate your strategy.

📘 Explore the Books

📅 Join a Workshop

📨 Contact Us (see footer)