3 Futures for the U.S. Economy: A Strategic Scenario Outlook

Explore what’s next—prepare, adapt, and lead with foresight.

The U.S. economy faces profound uncertainty. From fiscal expansion and rising tariffs to supply chain disruption and debt risk, policymakers and planners alike must prepare for multiple plausible futures.

Cleveland Fed President Beth Hammack recently outlined three credible economic scenarios in response to the 2025 “Big Beautiful Budget” and evolving trade policy. These scenarios illustrate how inflation, employment, and debt dynamics might unfold over the next 5–10 years.

Here’s a strategic summary of each scenario—based on real-world economic modeling and projected debt impacts. Use these to guide planning, budgeting, and scenario workshops.

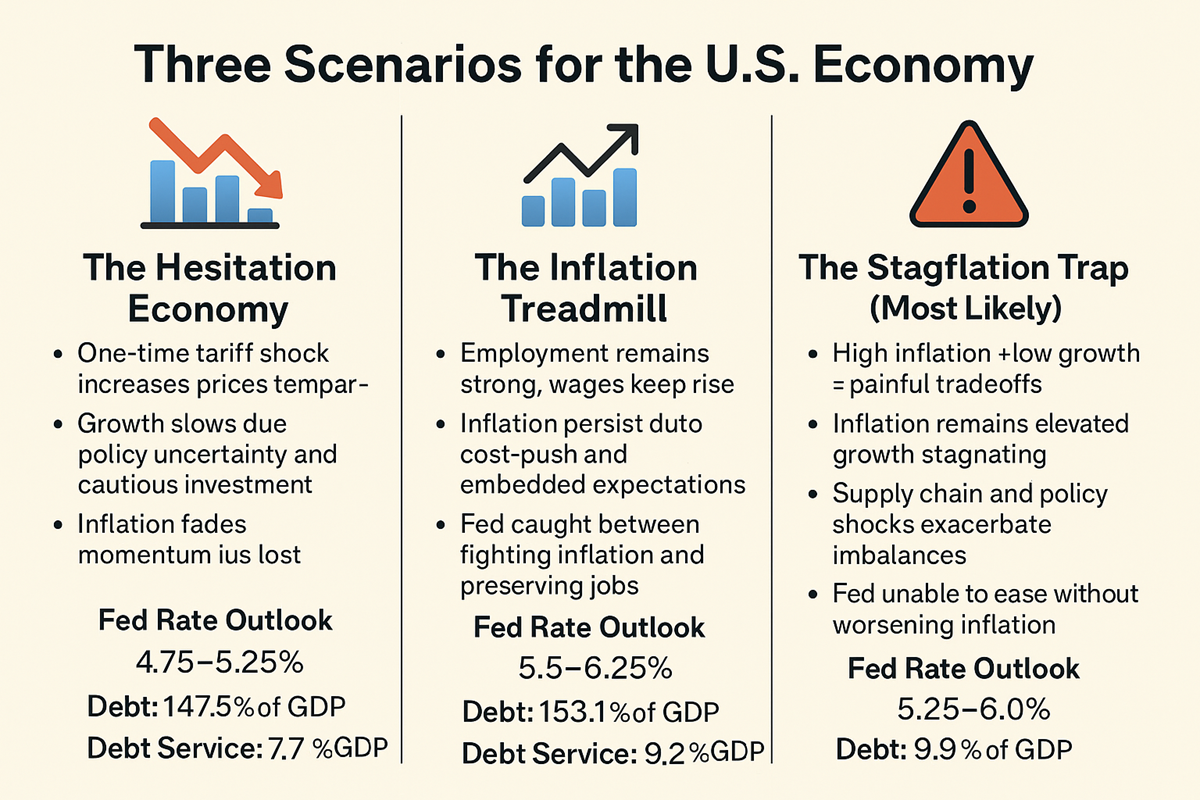

📉 Scenario 1: The Hesitation Economy

Short-Term Shock, Long-Term Pause

- One-time tariff shock increases prices temporarily

- Growth slows due to policy uncertainty and cautious investment

- Inflation fades, but momentum is lost

- Fed Rate Outlook: 4.75–5.25%

- 2032 Debt: 147.5% of GDP

- Debt Service: 7.7% of GDP; 43% of federal revenue

👉 Read the full scenario below (but the most likely, Scenario 3, is listed first).

📈 Scenario 2: The Inflation Treadmill

Strong Labor Market Meets Persistent Inflation

- Employment remains strong, wages keep rising

- Inflation persists due to cost-push and embedded expectations

- Fed caught between fighting inflation and preserving jobs

- Fed Rate Outlook: 5.5–6.25%

- 2032 Debt: 153.1% of GDP

- Debt Service: 9.2% of GDP; 51% of federal revenue

👉 Read the full scenario below (but the most likely, Scenario 3, is listed first).

⚠️ Scenario 3: The Stagflation Trap (Most Likely)

High Inflation + Low Growth = Painful Tradeoffs

- Inflation remains elevated, growth stagnates

- Supply chain and policy shocks exacerbate imbalances

- Fed unable to ease without worsening inflation

- Fed Rate Outlook: 5.25–6.0%

- 2032 Debt: 172.1% of GDP

- Debt Service: 9.9% of GDP; 55% of federal revenue

👉 Read the full scenario below (most likely, Scenario 3, is listed first).

📊 Want the Numbers?

Table 1: Debt and Debt Service Projections

| Scenario | Year | Debt (% of GDP) | Debt Service (% of GDP) |

| One-Time Shock | 2032 | 147.5 | 7.74 |

| Persistent Inflation | 2028 | 136.4 | 8.18 |

| Persistent Inflation | 2032 | 153.1 | 9.19 |

| Stagflation | 2028 | 144.6 | 8.31 |

| Stagflation | 2032 | 172.1 | 9.9 |

Here is the table comparing projected U.S. debt and debt service metrics under each economic scenario for the years 2028 and 2032, based on Trump’s proposed budget increases and associated fiscal implications.

Table 2: Debt & Debt Service Projections (2028/2032) with 2024 Baseline

| Scenario | Debt (% of GDP) (2028/2032) | Debt Service (% GDP) (2028/2032) | Debt Service (% Gov. Rev.) (2028/2032) |

| Current (2024) | 121.4 (—) | 5.46 (—) | 30.60 (—) |

| One-Time Shock | 133.8 (147.5) | 7.03 (7.74) | 39.35 (43.37) |

| Persistent Inflation | 136.4 (153.1) | 8.18 (9.19) | 45.82 (51.45) |

| Stagflation | 144.6 (172.1) | 8.31 (9.9) | 46.55 (55.41) |

The table now includes a baseline row for Current (2024) with actual values based on the following assumptions:

- GDP (2024): $28 trillion

- Federal Debt (2024): $34 trillion

- Federal Revenue (2024): $5 trillion

- Debt Service Rate (avg 2024): 4.5%

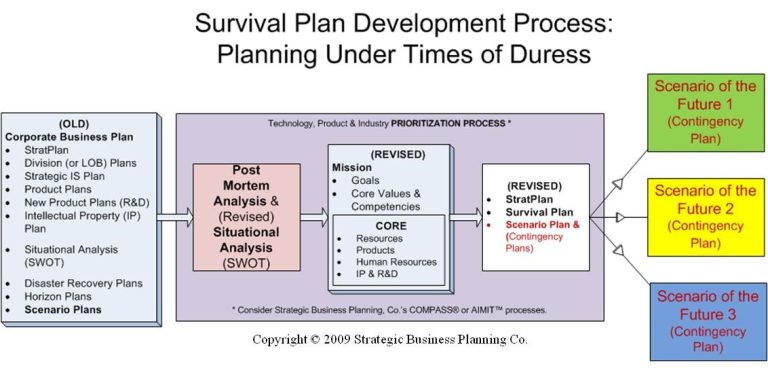

🧠 Ready to Plan?

Use these tools to prepare your organization, region, or community:

✅ Strategic Planning Workshops

✅ Scenario & Delphi Research

✅ Budget Contingency Modeling

✅ Risk Stress Testing

✅ AI-Enhanced Scenario Simulations

Built by the Strategic Business Planning Company using concepts/frameworks of Perpetual Innovation and assistance from ChatGPT 4o. Graphic produced by DALL-E with adaptations.

📘 Scenario 3 Draft: “The Stagflation Trap” (Hypothetical)

A Realistic Outlook Based on 2025 Policy Trends and Fed Scenarios

Problem Definition

In 2025, the U.S. government adopts what becomes known as the “Big Beautiful Budget,” a sweeping package of tax cuts, infrastructure commitments, and military spending increases. While initially popular, the fiscal expansion—passed by the House and signed into law—leads to widening deficits and a rapidly escalating federal debt.

Compounding the situation, tariffs on imports from China, the EU, and strategic partners increase costs across supply chains. Businesses face rising input prices and wages, while consumers experience climbing costs for everyday goods. Productivity growth stalls, and confidence begins to erode.

By late 2026, these forces converge into a textbook case of stagflation—a dangerous mix of high inflation and stagnating growth. This scenario, anticipated by Cleveland Fed President Beth Hammack and detailed in a recent Axios article, becomes the most probable of three outlined futures for the U.S. economy.

Strategic Questions

- Can the Federal Reserve contain inflation without worsening the slowdown?

- How can policymakers manage rising debt costs without triggering fiscal panic?

- What proactive strategies can organizations and municipalities adopt to endure prolonged stagflation?

Response and Planning Process

By mid-2027, the Federal Reserve finds itself cornered. Raising rates threatens to tip the economy into a deep recession, while easing would let inflation run unchecked. The Fed holds rates in a tight band of 5.5–6.0%, attempting to thread the needle between stability and damage control.

Meanwhile, debt service emerges as a dominant concern. According to our projections in Table 1: Debt and Debt Service Projections (2028/2032), the federal debt rises to 172.1% of GDP by 2032 under stagflation conditions, up from 121.4% in 2024. The interest burden alone exceeds 9.9% of GDP, and consumes over 55% of federal revenues, choking out policy flexibility and crowding out discretionary spending.

Compounding the problem, projected growth remains weak. As shown in Table 2: Fed Scenario Comparison Table, this scenario forecasts minimal productivity gains, falling consumer confidence, and a tight labor market that no longer generates the wage-driven demand of earlier years. Businesses, unable to pass on additional costs, delay investment and resort to cost-cutting.

Strategic planners across sectors respond by deploying scenario-based budget planning, creating contingency ranges for energy prices, wages, and financing costs. State and local governments pause infrastructure expansion and reassess long-term capital projects. Households shift toward conservative spending patterns, reinforcing the feedback loop of economic stagnation.

Lessons Learned

- Debt isn’t just a long-term concern—in a high-rate environment, debt service becomes a near-term budget killer.

- Stagflation limits all traditional tools. The Fed cannot simply “stimulate” or “cool” the economy—each move has major tradeoffs.

- Protectionist policies can backfire, especially when introduced during a period of tight supply and low growth.

- Scenario planning proved essential for resilience. The organizations and governments that endured best were those that built downside scenarios early and embedded fiscal stress testing into their planning cycles.

- Delphi panels provided foresight, helping leaders gather consensus on the most likely threats and timing of inflation plateaus.

📘 Scenario 2 Draft: “The Inflation Treadmill” (Hypothetical)

A Resilient Labor Market Meets Prolonged Price Pressure

Problem Definition

Following the passage of the 2025 “Big Beautiful Budget,” the U.S. economy experiences a burst of consumer and business activity. Fueled by tax cuts and infrastructure spending, demand remains strong—especially in housing, logistics, and healthcare. However, tariffs and regulatory changes disrupt supply chains, increasing the cost of goods over time.

What makes this scenario distinct is the persistence of labor market strength. Unlike stagflation, businesses retain workers to avoid repeating the costly hiring struggles of the early 2020s. Wages continue to rise—feeding consumer demand—but this also reinforces inflation.

By 2026 and 2027, inflation becomes entrenched, settling above the Federal Reserve’s 2% target, with year-over-year price increases hovering near 4–5%. The Fed’s challenge shifts from stopping a collapse to taming inflation without hurting job growth.

Strategic Questions

- Can the Fed restore price stability without risking mass layoffs or recession?

- How should businesses manage operating costs and pricing amid sticky inflation?

- What signals would indicate a shift from tolerable inflation to systemic overheating?

Response and Planning Process

The Federal Reserve responds by maintaining or slightly increasing interest rates, likely holding them in the 5.5–6.25% range—as shown in Table 2: Scenario Comparison Table. Unlike in stagflation, the Fed is not reacting to collapsing demand, but rather attempting to cool a hot labor market and slow inflation through monetary tightening.

In this environment, debt continues to rise, driven by persistent deficits and higher interest payments. According to Table 1: Debt and Debt Service Projections (2028/2032), total debt grows to 153.1% of GDP by 2032. Debt service accounts for over 9% of GDP and consumes more than half of total federal revenue—a major fiscal concern even in the absence of economic contraction.

Businesses face margin pressure as wage growth outpaces productivity in some sectors. Pricing strategies shift toward “justified inflation,” with firms bundling price increases with added features or loyalty benefits. Automation accelerates, especially in manufacturing, food service, and back-office functions.

Policymakers attempt “soft landing” strategies, including targeted subsidies, public-private retraining initiatives, and expanded green energy investment to enhance productivity. Some success is seen, particularly in logistics and domestic manufacturing.

Lessons Learned

- Strong labor markets can prolong inflation, especially when supply-side constraints remain unresolved.

- Tariffs and cost-push inflation should not be underestimated—they operate differently than demand-driven inflation and often require different tools.

- Scenario planning helps uncover hidden trade-offs. In this case, the cost of employment stability is persistent inflation and mounting fiscal strain.

- Delphi-informed planning enabled sector-specific foresight, guiding how industries prepared for cost escalation and wage sensitivity.

- Debt management is still a threat—even without recession, the cost of servicing the debt under high-rate conditions is unsustainable long term.

📘 Scenario 1 Draft: “The Hesitation Economy” (Hypothetical)

A One-Time Price Shock Slows Growth Without Sustained Inflation

Problem Definition

In early 2025, the newly enacted “Big Beautiful Budget” injects fiscal stimulus into the economy. Simultaneously, a series of tariffs are implemented on foreign imports, creating an immediate spike in prices. Consumers and businesses respond with caution. While inflation rises briefly, it does not become entrenched.

Instead, what emerges is a climate of uncertainty. Business leaders delay investment decisions. Consumers cut back on discretionary purchases. Supply chain stress and interest rate pressures cool demand, but the overall economic structure remains intact.

This scenario illustrates the effects of a one-time external shock, where the inflationary impact is significant—but not systemic.

Strategic Questions

- How long does it take for one-time shocks to work through the economic system?

- Can businesses afford to pause investment in the face of policy uncertainty?

- What are the indicators of a successful monetary response in such a scenario?

Response and Planning Process

In response to the temporary shock, the Federal Reserve takes a wait-and-see approach, keeping interest rates steady or possibly reducing them slightly to counter the growth slowdown. As shown in Table 2: Scenario Comparison Table, rates hover in the 4.75–5.25% range, lower than the other two scenarios.

Price inflation begins to taper by mid-2026, validating the view that the spike was tariff-driven and not symptomatic of deeper systemic overheating. However, economic growth remains muted. Businesses are cautious, fearing further policy surprises. Hiring slows, though unemployment remains relatively low.

Meanwhile, government debt continues to accumulate due to increased spending and weaker tax revenue growth. Table 1: Debt and Debt Service Projections (2028/2032) shows debt climbing to 147.5% of GDP by 2032. While this is better than in the other scenarios, debt service still rises meaningfully, reaching 7.74% of GDP and 43% of federal revenue by 2032.

Firms in this scenario adopt incremental strategies—avoiding big bets, maintaining liquidity, and investing in flexible, low-cost technologies like cloud systems and remote infrastructure. Policymakers focus on stabilizing expectations and clarifying future trade plans.

Lessons Learned

- Policy uncertainty can stall growth even without a true crisis. Businesses react to signals, not just outcomes.

- Short-term price shocks can be weathered, but only if expectations are managed and inflation does not become self-reinforcing.

- Debt remains a structural issue—even in a soft landing scenario, rising interest rates and elevated spending create long-term fiscal pressure.

- Scenario planning and sensitivity modeling help clarify strategy options, especially for capital investment, supply chain decisions, and hiring posture.

- Delphi-informed planning contributes valuable foresight—helping businesses distinguish between a one-time shock and a long-term trend.