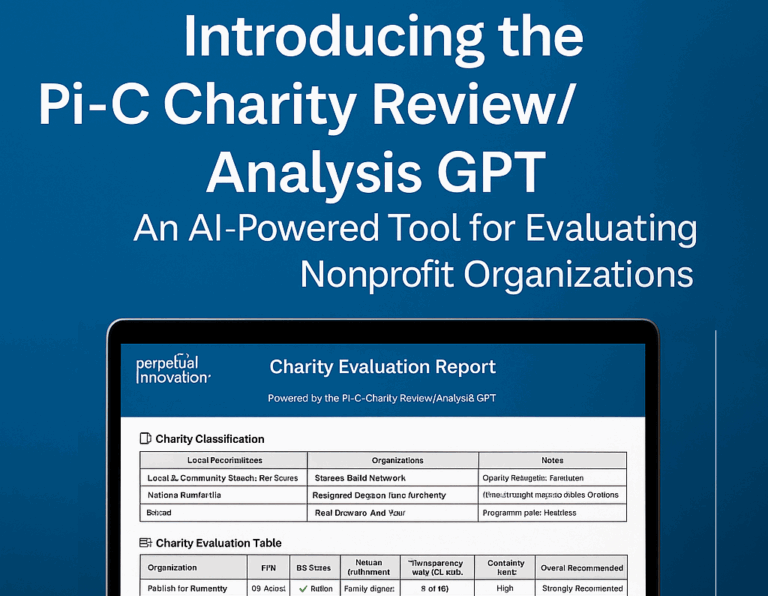

Evaluate Charities Smarter: Introducing the Pi-C Charity Review GPT for Donors & Civic Clubs

Published by: Perpetual Innovation™ | Strategic Business Planning CompanyDate: June 2025 Smarter giving starts with better insight. The new Pi-C Charity Review GPT helps donors, civic clubs, and funders screen nonprofits based on mission alignment, transparency, and public legitimacy — all in minutes. 👉 Try the GPT on ChatGPT.com What Is the Pi-C Charity Review GPT? Developed by Strategic Business Planning Company (SBPlan.com), this free AI tool helps individuals and service clubs evaluate nonprofits for…