The Misery Index hasn’t been talked about much since the

1970s when unemployment was really high and inflation was double digit. The

argument is that high unemployment is painful, and high inflation is painful,

so when you add the two together you get a good measure of the misery throughout

the economy. Both presidents Ford and Carter had average Misery indexes of 16,

but Carter when out of office in 1980 leaving a Misery Index of almost 20 to

Ronald Reagan.

|

| Pain Index |

Wikipedia does a great job of organizing information and

trends related to Misery Index

by country over time. The article presents 2013 as an example year, just a

couple years out of the worldwide Great Recession of 2007-2008. Several

countries had Misery Indexes of 60 or more (Venezuela, 79.4 and Iran, 61.6). The US had a Misery Index of 11 in 2013,

predominantly because of persistently higher unemployment, inflation was below

2%.) High inflation, or even hyperinflation, is usually associated with an

unstable economy. In 2019, Venezuela had

a Miser Index that was basically unmeasurable because of inflation that was

1000% or far higher.

In the 1980s, many Latin American countries had business

relations and huge debts that amplified the misery from the US, especially

loans that were payable in US Dollars. Many countries had misery indexes that

were twice that of the USA. Ouch!

Full Employment

Full employment was considered by economists at about 6% unemployment.

Six percent seemed like a good level of unemployed to allow for people moving

from location to location, job to job, entering and leaving the workforce. So,

the base misery index would be about 6 at full employment and 0% inflation. But

as we got into the 21st century, especially about 6 years after the

Great Recession, it became clear that full employment could be less than 6%,

Maybe 5%? At end of Obama era and into Trump years, unemployment moved down to

about 4%. With extremely low inflation, the Misery index dropped to a total of

about 5 or 6 in the US.

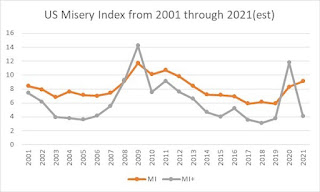

Modified Misery Index (MI+)

Some economists like to modify the misery index to reduce

the index by the amount of GDP growth.

Misery Index = Unemployment + Inflation (or MI = U + I)

Misery+ = Unemployment + Inflation – GDP Growth (MI+ = U + I

– ∆GDP

)

The pain of unemployment is obvious for the unemployed. For

the economy, a year in which a person is unemployed also a year lost worth of

GDP contribution from that person; let’s say a loss of GDP of twice (2x) that

person’s salary.

|

| US Misery Index (MI+) 2001 thru 2021 |

The pain of inflation is not so obvious. If inflation is 5%

and wages increase by 5%, then the average employee is equally well off.

Central bankers tend to aim for 1%, but less than 2% inflation. Higher inflation

can destabilize the economy (more) because it increases uncertainty and reduces

the ability of businesses, governments, and individuals to plan (and invest).

If the economy is growing, let’s say because of productivity

growth, then that can offset the level of pain and misery. Productivity growth

can be roughly represented in GDP growth.

Coming out of the Great Recession of 2008, unemployment had

risen to about 18%, inflation was consistently low, close to zero; and GDP

growth was chugging along at 2% to 3%. The

Misery Index was about 20. MI+ was about 17 (when reduced by 2%-3% GDP growth)

which looks better but is still painful. No one wanted to give up a job if they

had one; and getting a job if you had none, was ugly. This was misery and pain,

and the US was in much better positions than many countries (even though the

Great Recession was totally manufactured in the US housing asset bubble).

Countries that relied on tourism were hammered by the lack of visitors. No

business travel. The normal vacationers were hit by a triple whammy: no job, or

job uncertainty; the crash of savings and retirement funds; and the collapse of

the housing market where people were struggling to keep their homes or had

already lost them. Ouch! That was painful.

Recessions: Destructive Innovation

Recessions are good, and bad.

An old economics joke (if there are really any economic

jokes, maybe pun is better) is: What is the difference between a recession and a

depression? A recession is when your neighbor loses his job; a depression

is when you lose your job.

Recessions are destructive innovation. They accelerate the

retirement of old business models toward new and better. The Great Recession of

2008 and the Pandemic Recession of 2020, both accelerated transitions away from

big malls. The Recession 2020 massively accelerated online shopping and the

ability of employees to work from anywhere (telework). Surprisingly, most

businesses and schools didn’t really have the full ability to work online

(security, bandwidth, collaboration); now they can. Big campuses and office

buildings may never go back to full capacity.

On the macro level, the economy in 2019 was zipping along at

approximately full employment (4.5%) and a GDP of about $21.5T. During the big

pandemic shutdown in 2Q2020, the economy shrunk about 30%. That’s a lot like

turning off all the (economic) engines and diming all the lights with the hopes

that all the moving parts of the economy would be operational and in place when

the power comes back on. It seems that pandemic relief and the resilience of

the businesses/people allowed for a jump start back out of the recession.

Economic growth in 3Q2020 was +33%. By the end of 2021, the economy is/was

zipping along at about $23T annual GDP. Wow.

But the economy is different in small and big ways. The

pre-pandemic economy was 70% services (69%, actually). Now people are buying

more goods and only 65.5% services. Both the goods, and the services are

different now. Very little international travel, so countries relying on

international leisure and business travelers are getting hammered. More to fix

up your house. Try buying a boat, an RV, an ATV, an auto, or a house! People are buying differently; think Amazon,

eBay, Etsy.

The toilet paper problem during the pandemic was that there

were two supply chains for toilet paper: the soft and cushy 2-ply for

households, and coarse (Brillo pad) single-ply for businesses and government.

Turns out they were totally different supply chains.

Changes in supply chains, increased demand along many supply

chains and supply interruptions (labor, containers, etc.) all resulted in

shortages and cost increases. The biggest factor in 2021 inflation is energy,

which filters through all aspects of the economy into the food chain and supply

chains.

Oil demand went back above 100 million barrels per day, in

an industry (fossil fuels) that needs to be discontinued sooner, not later, to

meet climate goals. The transition away from fossil fuels, will be disruptive. Why

invest more in rigs, pipelines, and tankers if the entire industry needs to be

phased down in 10 years and phased out in 30 years?

BIG oil (Saudi, Russia, Exxon, etc.) is hoping we will never

make the switch off our oil-addiction… After 40 years of talking about it, they

seem to be largely correct.

Healthy Consumers

During the Pandemic Recession, many people saved lots of

money. First, there was no good place to spend money, except maybe to fix up

your house. The Federal Government shoveled out buckets of money to families.

And, for those people who kept their jobs, most of them had suddenly reduced

their monthly expenses in traveling to work and eating out. Staycations, not vacations. Personal and

Institutional savings went from just over $1T in 2019 to $4T 1Q2021 (BEA.gov).

Housing values have jumped by 30%, 40% or even 50% in many

locations, leaving those people lucky enough to own housing real estate in a

very sweet position. Selling may be the easiest it has been in decades. Low

interest rates and very few properties for sell. Since the Great Recession we have

built far too few houses, so there really is a bit of a housing shortage; no

bubble in sight. Of course, people looking to buy, or rent, are not going to be

happy.

The stock market, and retirement funds, have gone only up

since the great recession. There was a retraction for the pandemic, but

otherwise it has continued to go higher. In 2021, all the US markets were up

dramatically with the S&P 500 up 25+%, hitting 70 all-time highs throughout

the year. Many market analysists think a small correction, or even a big

correction, is near; but the bulls seem to be winning almost every week.

So, let’s see if we have this right? Unemployment is the

lowest it has been in our lifetime. Employment opportunities are the best they

have every been with job openings exceeding the applicants by 2 or 3 times. If

people want to go back into the workforce they can, but they can probably

afford not to work for the indefinite future. The house is probably worth

several times what you paid for it. Investments are good and retirement fund is

bulging at the seams. Your old car is worth more than you paid for it 5 years

ago.

Inflation is up, especially for housing, fuel, and food;

but, if your salary is up as well, that shouldn’t be too bad. The cost-of-living

increase is 5.9% for retirees who probably own their house and don’t drive

much.

Your biggest problem is you must wait 6 months for your new

car; and you may have to postpone, again, your international vacation. Consumers

may be in better positions than they have been in years.

Why do many people think the economy is in the toilet and

why are so many people so anxious?

Anxiety and Fear

The consumer is probably better, financially, then he or she has been for a couple decades. But COVID uncertainty and political divisiveness has wreaked havoc. And then there is the new, wildly prolific, Omicron strain of COVID-19. Normally during times of war or major uncertainty, the US has pulled together. Not this time. That doesn’t seem to be happening.

Somehow, we seem to have dropped into the abyss that news outlets have fallen into. Good news, and even great stats, are a yawn. Bad news, with death and mayhem, that’s news! So, news outlets have moved to sensationalizing. And talking heads perpetually pander to their base. It is hard to find fair and unbiased sources, and most people have gotten to where they don’t want or believe real news.

Fear mongering seems to work, at least to build followers.

And everyone is always stressed out. Even if things are really quite good, all things considered. Especially when considering that we’ve had two-year of pandemic, and more than 800,000 US deaths associated with COVID. We’ve had a world economy come to a complete stop and now we are some 5% further than before. That is pretty spectacular.

Look at how far we have come up the mountain range, not at the last high peak. Imagine how easy things might be if we all worked together?

#Innovation #DestructiveInnovation #MiseryIndex #Inflation

#Unemployment #EconomicDevelopment