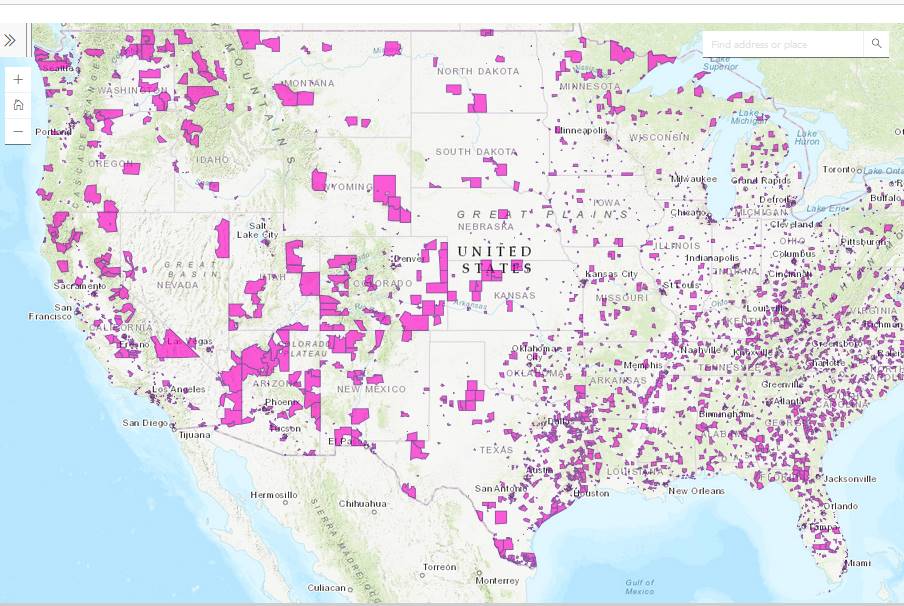

Opportunity Zones present a hidden opportunity for Real Estate (RE) investment that should be widely utilized across the US. Why not? (View Interactive HUD Map here.)

There’s a spectacular investment tool that was associated

with tax cuts of 2017 by the Trump administration. Along with the massive tax

cuts, there was a non-partisan tax break to funnel private investments into

underdeveloped communities around the nation.

It took a couple years for the census tracts in every state

to be identified and for the final definition of the program. There are 8,700+

census tracts across the US that are designated as “zones”. Most people are

surprised to find that they live in, or within a few miles, of one of these

special tax – legal loophole – areas. There are at least two major reasons why

these special zones have not received substantial attention and engagement: massive

confusion related to the name, Qualified “Opportunity Zone” (QOZ); and, the

COVID pandemic/recession.

OZ, We’re not in Kansas Anymore, Toto.

Using the term “Opportunity Zone” for these census tracts

across the nation, was a horrible idea. People think of Enterprise Zones (EZs),

Industrial Parks, Community Redevelopment Areas (CRAs) and such when they hear

“Opportunity Zone”. Enterprise Zones are usually a specific campus or

industrial park, so a business has to locate, or relocate there. Plus, an EZ

usually has specific target business development such as light-industrial, or

high-tech research. Business incubators often are located inside an EZ. Foreign Trade Zones (FTZs) might be added to

EZs where there is a port (or airport) of entry to enjoy special import/export

treatment. Anyone, and everyone, who hear about Qualified Opportunity Zones for

the first time have to disconnect their thinking from the historic use of

“Opportunity Zones”. Essentially, we’re not in the land of OZ anymore, we’re in

a qualified version of OZ, a Q.O.Z. Maybe a better approach would be to

redefine a term or acronym for QOZ. It is a legal tax loophole related to

designated census tracts; maybe calling it something a Qualified Opportunity

Tax Area would be better. Let’s use QOZ for the qualified tax areas; and

QOZ-Fund for the formal bank account of the qualified company that manages

QOZ funding and reports to the IRS; and QOZ-Property for the real estate

investments that are central to the QOZ project.

Probably and equal put-off is that an investment in a QOZ

goes into a “Fund”. This sounds complicated, a lot like setting up and managing

your own mutual fund; however, it is surprisingly straight-forward. Essentially, set up a bank account specific

to the real estate investment within a qualified census tract; let the IRS know

on a form (Form 8997) that money has come in from capital gains of an investor;

and later let the IRS know that the property has been sold and that taxes are

now payable. (Taxpayers file a Form 8949 each year illustrating how much

capital gains tax continues to be deffered.) The investors’ capital gains taxes

could, and should, be much lower in addition to being deferred. The funding associated with such an investment

is called an Opportunity Zone Fund (QOZ-Fund).

The Opportunity

Zone program creates a tax incentive for individuals who reinvest unrealized

capital gains into high-impact, long-term projects in high-poverty communities

across the country. It is based upon bipartisan legislation authored by U.S.

Senators Cory Booker (D-NJ) and Tim Scott (R-SC). (Booker press release, Oct

31, 2019)

The Opportunity

Zones provision is based on the bipartisan Investing in Opportunity Act, which

was championed by Senators Tim Scott (R-SC) and Cory Booker (D-NJ) and

Representatives Pat Tiberi (R-OH) and Ron Kind (D-WI), who led a regionally and

politically diverse coalition of nearly 100 congressional cosponsors. (Economic

Innovation Group, https://eig.org/opportunityzones/history)

Who should consider QOZ projects?

Answer 1: Anyone involved in real estate in or adjacent to a

designated QOZ census tract. This, of course, includes Realtors® and mortgage

lenders, builders, and contractors. (Illegal businesses, and “sin” businesses

like cassinos, do not qualify.) There are the parties that are exchanging property

in a real estate sale, of course. The seller would likely have capital gains

from the sell of the property that could/should be invested somewhere; and a QOZ

fund investment would allow for deferring or completely avoiding taxes on the

capital gains. The buyer(s) might want to purchase using their own capital

gains (from any source). Even outside parties might want to jump in and invest

in a real estate (or development) project so that they can avoid and defer

paying capital gains taxes.

Answer 2: Anyone with capital gains should be interested. This

introduction of outside parties to a real estate project within a QOZ is

probably the biggest paradigm shift for many people. Everyone is comfortable

with bank (debt) financing but using outside (equity) investors may be novel

for many real estate developers. There is no reason to avoid debt (bank)

leverage, but the change in ownership will restructure the funding from all

sources.

Investors: Capital Gains and Benefits of Taxes Avoided/Delayed

The beauty of compounding is an almost magical thing. A 7%

return on investment would double in value about every 10 years. So, a $100,000

investment might easily grow to a $200,000. That is a reasonable investment

growth rate for the value of real estate, even if there were no improvements or

operating profits (like from apartments or offices). But the investment in a QOZ

Fund would be from moneys that would otherwise be subject to capital gains taxes.

For most investors this would be 20% or higher tax rates. So instead of

investing the $100,000, taxes would go to the IRS leaving only about 80,000 to

invest today. Stated differently, to make the $100,000 investment today, you

would need $125,000 of money that was taxed at 20% capital gains. (Capital

gains can be much higher, especially for short-term capital gains.)

QOZs are a longer-term investment tax mechanism. If you keep

the investment for 10 years, you pay no taxes (0% tax rate) on the “profits”

when you sell and cash out of the investment. Wow!… And the taxable amount of

your original investment will be reduced by approximately 10% if you keep the

money invested for 5 years (or more). There is a deadline of December 31, 2026

to reach the 5 year deadline; this deadline puts some pressure to complete a QOZ

investment into a fund by the end of 2021. After 2021, the 5-year stepdown of

10% will no longer be possible, but taxes on the original investment will still

be deferrable until the end of 2026. (There was an additional tax break at 7

years, but that stepdown of taxes is no longer possible because of the 2026

deadline.)

Eventually, you have to pay capital gains on at least part

of the original investment, but the time that taxes are deferred is time in

which the compounding of the investment works in your favor. This is a little

like a traditional IRA, you invest tax-free money today, but pay taxes in 30

years when you start to withdraw; but during that 30-year period your money

plus the money that would have gone to the IRS for taxes has been working for

you. Hopefully, doubling, and then doubling again.

Map of QOZ Investment Tracts

How do you know which areas are designated for this special

OZ tax treatment. The Housing and Urban Development (HUD) has an interactive

map that allows you to zoom in on a region to find the census tracts that are

given this special investment status. See the US Map of QOZ census tracts at

HUD: https://opportunityzones.hud.gov/resources/map

Some listing services show properties that are in QOZs. So,

your favorite Realtor would be able to tell you when properties you look at are

within QOZ tax havens. QOZ status should help to bolster property values.

Alaska has massive QOZ tracts, and all of Puerto Rico is a QOZ.

There are several groups who gather QOZ investment

opportunities around the nation and investors with capital gains to invest. One

group, OpportunityDB.org, does podcast

and provides a catalog of various QOZ projects. Many Banks and investment

houses will assist in creating a QOZ or with finding Funds to consider for

investing your capital gains.

Capital Gains in the Future

The future is uncertain. Many people find themselves locked

into assets (stocks, real estate, etc.) because selling them would incur a huge

tax on capital gains. Stocks that you bought in a brokerage account at $10 per

share are now at 10 times that. Virtually all capital gains! The QOZ program is

a mechanism to jump out of investments that are in a Capital Gains Trap.

If you bought property for $1,000 and now it will sell for

$50,000? Well, there is a mechanism for “like” real estate investments where

you can move your investment (and profits) from one property to another. But

there are lots of restrictions to this 1031 tax deferment. Plus, you now have

your principle and profits tied up in the new real estate.

But, if you cash out your profits this year, and know that

you will have to pay capital gains – at least in part – in 5 years, then you

might be worried about the capital gains rate going up under a Democrat/Biden

Federal Government. (Capital gains would be the most likely, if any, of the

possible tax hikes within the next 10 years.) But with an QOZ, you are taking

out capital gains now, with the expectation of reducing tax payments in the

future and avoid all taxes on the profits this investment generates. If you

keep your current capital gains locked up, the lock would be even worse if/when

capital gains rates go up in the future. Essentially, the Capital Gains Trap gets

even bigger.

On the tax side, if you invest in a QOZ in 2021, you should

start to manage your cash flows for paying some taxes on your capital gains in

5 years. Your tax forms show (much like your IRAs) how much money you have in

tax-deferred status. Paying taxes in 5 years, is usually better than paying

taxes today.

Profits are a Wonderful Thing

You should rejoice in making profits. All things equal, you

should prefer to pay higher taxes because that means that you are making a lot

of income (profits). In general, you should make your finance and investment

decisions without considering taxes, and then factor in the tax implications. A

good investment will rarely be negated by the tax adjustments; but a marginal

investment might be swayed by tax considerations. Evaluate carefully where you

invest to make sure the QOZ investment is a profitable venture prior to any tax

benefits.

You should never make financial decisions solely based on

taxes. Many people have much of their

life’s savings tied up in a couple asset (classes) that are heavily subject to

capital gains taxes. The QOZ investment mechanism is a great way to work on

cashing out of some of the “capital-gains locked assets”.

It is surprising how little the QOZ tax deferral program

seems to have been utilized. Makes you wonder why?

The IRS

provides questions, answers, and a lot of confusion on the topic. Be sure

to seek advice from professionals who have QOZ knowledge and experience (CPA, RE

Attorney, Financial Planner, etc.) before making the leap into – and out of –

QOZ investments. Of course, if you are

single, you can try to marry someone who has lost lots of money; then your

profits might wash with their losses. What could go wrong with that strategy?

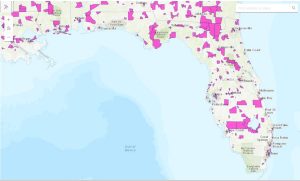

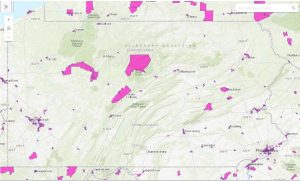

QOZ tracts for Florida and Pennsylvania.