A

question I sometimes ask of people who think that fossil fuels are here

forever more and that electrification of everything will never

happen…

Has there ever been an oil spill in Yellowstone National Park? If so, how many?

The answer I get surprisingly often is “none”. It is, after all, a National Park, right?

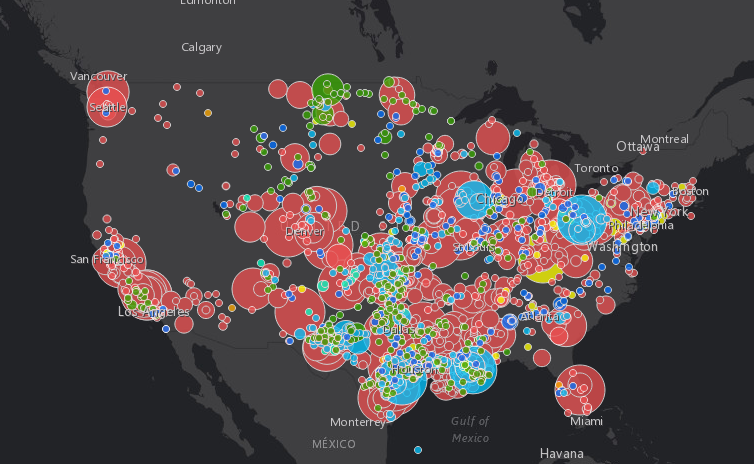

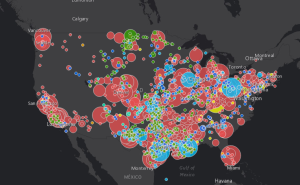

ArcGIS

does a map overlay with the data of your choice. In this case the data

is documented oil and gas spills since 2010, by type of spill and the

SIZE of spill. Map for North America here.

The size of the circle indicates the size of the spill. Note the big

circles; size of the circle indicates the size of the spill. Blue is

refined oil (gasoline, diesel, etc.). Red is NatGas. Since NatGas just

vents into the atmosphere (unless it catches fire or is flared), it’s a

“clean” spill. Kinda. Natural Gas is a wicked greenhouse gas, with a

warming factor of 80x more than carbon dioxide.

The next chart just shows oil & gasoline spills. Crude oil in green (ironically), refined petroleum in blue. Zoom in and select a circle to find out more about the spill (year and amount).

Yellowstone is in the northeast corner of Wyoming. Yellowstone has had two notable oil spills

since 2010: an oil spill on the Exxon-Mobil pipeline in 2011, and

another spill in 2015 from the pipeline owned by the True Companies.

Those spills seem tiny compared to the thousands of spills throughout

North America. No info from Canada though. There have been many oil

spills in the Alaska pipelines that run all the way through Canada to

the US.

Note that there are tens of thousands of old wells that

have been abandoned; many have never been capped or have been poorly

capped. Old wells are leaking massive amounts of oil and natgas. The big

oil companies sell off the depleted wells to small companies. Those

companies milk the well for a while and then go out of business.

“According to the Government Accountability Office, the 2.1 million unplugged abandoned wells in the United States could cost as much as $300 billion.[2]” from this Wikipedia article on Abandoned Wells in the United States.

There are abandoned oil wells everywhere: in the gulf, in Pennsylvania,

in Texas, in California. And that is in the USA where there are better

regulations than most countries. Read about the Biden effort to go out

and cap them at the NRDC. There are lots of other sources, but you get the idea.

When

you think of the costs to the environment, the costs to clean up, and

the costs to not cleanup, the costs are massively greater than what you

pay at the gas meter or at the pump. And yet the world’s governments

still subsidize fossil fuels at the rate of $1T per year. According to the IMF, explicit fossil fuel subsidies are about 1% of GDP, but implicit is 6% to 7% of GDP (about $6T USD).